Historical Timeline

History of Insider Trading, 1611-2012, with an Emphasis on Congressional Insider Trading

| 1611-1799 |

1800-1929 |

1933-1949 |

| Birth of stock markets |

Growth of markets and financial scandals |

Beginning of government attempts to regulate insider trading |

| 1950-1969 |

1970-1979 |

1980-1989 |

| Congress begins to standardize rules to prevent financial misconduct by government officials |

Government-wide financial rules extend to legislative, executive, and judicial branches. |

Increased Congressional and SEC attempts to strengthen insider trading regulations; Supreme Court checks SEC power in rulings |

| 1990-1999 |

2000-2004 |

2005-2012 |

| Congress, SEC, and Supreme Court strengthen insider trading law |

Financial scandals bring insider trading to greater public attention |

Increased public scrutiny of Congressional insider trading and attempts to prohibit trading on Congressional insider knowledge |

|

1611 - 1799

Birth of Stock Exchanges in Europe • US Constitution Gives Congress Self-Discipline Authority for Financial Wrongdoing • Birth of US Investment Markets • First Inside Trader Causes the First US Market Crash • Buttonwood Agreement Sets the Stage for the Creation of the NYSE |

| Date/Event |

Description |

|

1611

Birth of Stock Exchanges in Europe |

|

| Royal Stock Exchange, London, Printed by Daumont ca. 1760. Source: Philographikon Gallery website (accessed Jan. 9, 2009) |

"The European stock exchanges, or bourses, as they were called, were established in the seventeenth century as places where governments could sell their own loans (bonds) and the large mercantile trading companies could raise fresh cash for their overseas adventures. The Dutch developed their bourses first, as early as 1611, with the English following about seventy-five years later.

Besides trading commodities vital to the developing mercantilist trade, both bourses began to actively trade new concepts in financing—shares and loans or bonds. Governments and the early trading companies began to look upon private investors as sources of capital. Borrowing from investors was preferable to raising taxes... Investors warmed to the idea of share ownership because it limited their risk in an enterprise to the amount actually invested in it... The exchanges developed primarily because both countries were the birthplaces of modern mercantilism and industrial capitalism. Equally, the British and the Dutch exported much capital abroad, in hope of reaping profits from overseas ventures."

Charles R. Geisst, PhD    Wall Street: A History from Its Beginnings to the Fall of Enron,2004 Wall Street: A History from Its Beginnings to the Fall of Enron,2004

|

|

1788

US Constitution Gives Congress Self-Discipline Authority for Financial Wrongdoing |

"The authority of Congress to discipline its Members is found in Article I, Section 5, clause 2 of the Constitution, which states in part, 'Each House may determine the Rules of its proceedings, punish its Members for disorderly Behaviour, and, with the Concurrence of two thirds, expel a Member.' Through the years, disorderly behavior has become synonymous with improper conduct such as support of rebellion, disloyalty, corruption, and financial wrongdoing, particularly for personal gain."

Congressional Research Service (CRS)  "Enforcement of Congressional Rules of Conduct: An Historical Overview" (180 KB) "Enforcement of Congressional Rules of Conduct: An Historical Overview" (180 KB)       , updated Nov. 18, 2008 , updated Nov. 18, 2008

US Constitution (49 KB)  , 1788 , 1788 |

|

1790

Birth of US Investment Markets |

"The [US] federal government refinances all federal and state Revolutionary War debt, issuing $80 million in bonds. These become the first major issues of publicly traded securities, marking the birth of the U.S. investment markets."

NYSE (New York Stock Exchange) Euronext  "Timeline," www.nyse.com (accessed Jan. 9, 2009) "Timeline," www.nyse.com (accessed Jan. 9, 2009) |

|

1792

First Inside Trader Causes the First US Market Crash |

|

| William Duer portrait. Source: Ohio History Central website (accessed Jan. 9, 2009) |

In 1789, upon the establishment of the US Department of the Treasury, William Duer was appointed Assistant Secretary, under the first Secretary of the Treasury Alexander Hamilton.

"[William] Duer had the distinction of being the first individual to use knowledge gained from his official position to become entangled in speculative trading; in effect, he was the first inside trader."

Charles R. Geisst, PhD    Wall Street: A History from Its Beginnings to the Fall of Enron,2004 Wall Street: A History from Its Beginnings to the Fall of Enron,2004

"The market first crashed in 1792, soon after the nation's birth, thanks to a merchant prince named William Duer. He was a man of wide-ranging business interests who had supported and made money off the Revolution and who then married into the upper reaches of New York society. He thought he could use his insider connections to Alexander Hamilton to make a killing by speculating in the newly issued debt of the infant government. As so many would after him, Duer overreached. Borrowing heavily to finance his illicit schemes, he went bankrupt when the bubble burst. The New York City economy crashed along with him, and Duer was nearly disemboweled by an enraged mob that chased him through the streets. He died in debtors' prison a few years later."

Steven Fraser, PhD    "The Genealogy of Wall Street Crime," Los Angeles Times, Jan. 30, 2005 "The Genealogy of Wall Street Crime," Los Angeles Times, Jan. 30, 2005 |

|

May 17, 1792

Buttonwood Agreement Sets the Stage for the Creation of the NYSE |

"For market participants, the message of 1792 was clear: Clean up trading practices or risk greater volatility. A number of surviving brokers decided that self-regulation was the answer, so twenty-four brokers gathered on May 17, 1792 and signed what was to become

|

| Early trading in the US beneath a buttonwood tree. Source: Wall Street Journal website (accessed Jan. 9, 2009) |

known as the Buttonwood Agreement. Named after a popular buttonwood tree at 68 Wall Street, the agreement stipulated in writing that the assembled brokers would trade only with each other. In other words, brokers had to be mutually recognized...

Consequently, the Buttonwood Agreement began what would be a long history of self-regulation in the U.S. securities markets. With the market now limited to just the recognized market participants, the Buttonwood Group moved to a private room at the Tontine Coffee House on Wall Street to conduct business. From these beginnings, the Buttonwood Group would morph in 1817 into a more formal organization, known as the New York Stock [&] Exchange [Board]. In 1863 the name would finally be changed to the current name, the New York Stock Exchange [NYSE]."

Scott B. MacDonald, PhD    , and Jane Elizabeth Hughes, MA, MBA , and Jane Elizabeth Hughes, MA, MBA  Separating Fools from Their Money: A History of American Financial Scandals, 2006 Separating Fools from Their Money: A History of American Financial Scandals, 2006 |

|

Top |

|

1800 - 1929

Government Officials Profit from Manipulating Railroad and Mail Company Stocks • US Congress Censures US Rep. Oakes Ames for Crédit Mobilier Scandal • Jay Gould Profits by Manipulating Erie Railroad's Stock and Bribing Legislators • US President Ulysses Grant and the Collapse of the Gold Market • US Supreme Court Rules Insiders Must Disclose Nonpublic Information in Strong v. Repide • Kansas Adopts the "Blue Sky" Law to Register Companies and Brokers Selling Securities • JP Morgan & Co. Exercises Influence in the Government • Stock Market Crashes and Great Depression Begins |

| Date/Event |

Description |

|

1800s

Government Officials Profit from Manipulating Railroad and Mail Company Stocks |

"Early in the history of the New York Stock Exchange, the tempting link between speculative finance and politics proved strong. When one of New York's early railroads, the Harlem Railroad, began trading publicly, a Senator Kimble of the New York legislature publicly

|

| Chathem to New York train on the Harlem Railroad. Source: Harlem Valley Rail Trail website (accessed Jan. 9, 2009) |

opposed its enlargement... The current price [of the railroad's stock] was benefiting from an 'inflation'... Kimble and others took the occasion to begin 'cornering' the stock...They did not actually own the stock but were selling it short... In order to ensure a price drop, Kimble then pushed a bill through the legislature calling for the enlargement of the railroad, causing its stock to fall on the exchange as investors realized that enlargement meant being diluted of their current shareholdings... The short sales were covered and profits realized...

|

| Russell Sage portrait. Source: Russell Sage Foundation website (accessed Jan. 10, 2009) |

The career of [former US Congressman] Russell Sage is a prime example of chicanery combined with financial acuity... The period prior to the Civil War saw Sage engaged in many railroad deals, usually using his insider's knowledge gained in Congress to move in on deals at the appropriate time... Sage had engaged in numerous business deals that made him a sizable fortune during the war. Among them was an investment in the Pacific Mail Steamship Company... The company received heavy government subsidies... These subsidies made the company ripe for the occasional sale of securities, which its directors could then make good use of as they saw fit... A congressional committee that investigated the company in 1873 discovered that its monopoly was granted by Congress only after a series of bribes and manipulations. Sage claimed innocence of any wrongdoing..."

Charles R. Geisst, PhD    Wall Street: A History from Its Beginnings to the Fall of Enron, 2004 Wall Street: A History from Its Beginnings to the Fall of Enron, 2004 |

|

Feb. 27, 1873

US Congress Censures US Rep. Oakes Ames

for the Crédit Mobilier Scandal |

|

| Oakes Ames portrait. Source: Public Broadcasting Service (PBS) website (accessed Jan. 9, 2009) |

"Oakes Ames [US Representative (R-MA)], Thomas C. Durant, and a few other influential stockholders of the Union Pacific organized the Crédit Mobilier under an existing Pennsylvania charter, which they took over. Acting for both the Union Pacific and for their newly created construction company, they made contracts with themselves. Oakes Ames, as head of the Crédit Mobilier, in 1867 assigned contracts to seven trustees to build the remaining 667 mi (1,074 km) of road for a total sum that brought profits variously estimated at from $7 million to $23 million. This process depleted generous congressional grants to the Union Pacific and left it under a heavy debt by the time of its completion in 1869.

The scandal became political when Ames (a U.S. Representative), to forestall investigation or interference by Congress, sold or assigned shares of the Crédit Mobilier stock to members of Congress at par... He wrote to Henry S. McComb, an associate, that he had placed the stock 'where it will produce the most good to us' and subsequently forwarded a list of Congressmen who had received or were to receive shares. Later friction between Ames and McComb facilitated the publication of these letters... A subsequent investigation by Congress badly smirched the political reputations of Vice President Schuyler Colfax, Senator James W. Patterson of New Hampshire, Representative James Brooks of New York, and others—most of all, of course, Ames himself. Ames and Brooks were censured by Congress [on Feb. 27, 1873], but there were no prosecutions."

"Crédit Mobilier of America," Columbia Encyclopedia   , 2007 , 2007 |

|

1868

Jay Gould Profits by Manipulating Erie Railroad's Stock and Bribing Legislators |

|

| Jay Gould. Source: encarta.msn.com (accessed Jan. 12, 2009) |

"American financier and railroad builder Jay Gould (1836-1892) began as an unprincipled stock manipulator and became one of the most acute businessmen in America's age of industrial capitalism... He traded in the securities of his own companies, manipulating banks he was associated with to finance his speculations and corrupting legislators and judges...

In 1867 Gould was already on the board of directors of the Erie Railroad, which was in financial difficulties. He set out to control it, push its expansion westward as far as Chicago, and defeat Cornelius Vanderbilt's efforts to acquire this potential competitor. Gould was the behind-the-scenes strategist (using Daniel Drew and James Fisk as his fronts) in the 'Erie war' with Vanderbilt in 1868. To check Vanderbilt, Gould issued 100,000 shares of new Erie stock by illegally converting debentures and then went to Albany, where, with the Erie's money, he bribed legislators to legalize the conversion. Vanderbilt discovered he had met his match and settled with Gould, receiving $1 million as a sweetener and leaving the Erie to Gould. Gould launched the Erie on an expansion campaign that vastly increased its capital debt. Meanwhile, he traded in Erie stock, sold it short, and made a killing before the road went bankrupt in 1875."

Louis M. Hacker, PhD    "Gould, Jay (1836-1892)," Encyclopedia of World Biography, Ed. Suzanne M. Bourgoin, 1998 "Gould, Jay (1836-1892)," Encyclopedia of World Biography, Ed. Suzanne M. Bourgoin, 1998 |

|

Sep. 24, 1869

US President Ulysses Grant and the Collapse of the Gold Market |

|

| US President Ulysses Grant portrait. Source: www.whitehouse.gov (accessed Jan. 12, 2009) |

"...Ulysses S. Grant's popularity slipped as his presidency progressed and scandals damaged his reputation. None struck closer to home than Black Friday -- the collapse of the U.S. gold market on September 24, 1869... At the root of the scandal were two well-known scoundrels, Jay Gould and Jim Fisk... They hoped that the government would hold onto its gold. Meanwhile, they would buy up as much gold as they could... When the price of gold got high enough to gain them a huge profit, they would sell... To convince Grant not to sell gold, the two schemers recruited a man named Abel Rathbone Corbin. Corbin, also a financier, had married Grant's sister Virginia... Corbin convinced Grant to name General Daniel Butterfield as assistant treasurer of the United States. Part of Butterfield's job was to handle government gold sales on Wall Street. In return for a piece of the action, Butterfield agreed to tip the schemers off when the government was ready to sell gold... When he[Grant] discovered a letter from his sister to his wife discussing the matter, he knew he was being conned...

|

| New York's Gold Room on Black Friday, Sep. 24, 1869. Source: Project Gutenborg website |

Soon after, Grant ordered the sale of $4,000,000 in government gold... But when the government gold hit the market, so did panic. Within minutes, the price of gold plummeted, and investors scrambled to sell their holdings. Many investors had obtained loans to buy their gold. With no money to repay the loans, they were ruined. Among those who lost big on Black Friday was Abel Corbin. The wily Gould escaped disaster by selling his gold before the market began to fall. In the Congressional investigation that followed, General Daniel Butterfield was removed from his post. But loyal Republicans refused to allow the testimony of Virginia Corbin and First Lady Julia Grant."

Public Broadcasting Service (PBS)   "People & Events: Black Friday, Sep. 24, 1869," www.pbs.org (accessed Jan. 12, 2009) "People & Events: Black Friday, Sep. 24, 1869," www.pbs.org (accessed Jan. 12, 2009) |

|

May 3, 1909

US Supreme Court Rules Insiders Must Disclose Nonpublic Information in Strong v. Repide |

"The illegality of insider trading on non-public information had not been established until the early 20th century. In the United States before 1909, for example, there was no legal obligation for an insider trader to disclose nonpublic information. The only exception was the case of fraud that was not easy to prove... In the leading case of Strong v. Repide in 1909, the U.S. Supreme Court established that a company official is obliged to disclose her identity and nonpublic information when she trades the company stocks."

Hongming Cheng, LLM, PhD    "Insider Trading," Encyclopedia of White-Collar & Corporate Crime, Ed. Lawrence M. Salinger, PhD, 2005 "Insider Trading," Encyclopedia of White-Collar & Corporate Crime, Ed. Lawrence M. Salinger, PhD, 2005

Strong v. Repide (81 KB)  , May 3, 1909 , May 3, 1909 |

|

1911

Kansas Adopts the "Blue Sky" Law to Register Companies and Brokers Selling Securities |

"Kansas adopts the 'Blue Sky' Law, which requires companies issuing securities to file a description of their operations and receive a permit before selling stocks. It also imposes registration requirements on brokers who sell securities. Within two years, 22 other states pass similar laws. An effort to pass a similar law at the federal level fails."

NYSE (New York Stock Exchange) Euronext  "Timeline," www.nyse.com (accessed Jan. 9, 2009) "Timeline," www.nyse.com (accessed Jan. 9, 2009) |

|

1920s

JP Morgan & Co. Exercises Influence in the Government |

"In the late 19th and early 20th centuries, JP Morgan & Co. was the world's most powerful bank. It was America's unofficial central bank, served as international guardian of the gold standard, and halted periodic financial panics (from which it profited)...

Morgan exerted extraordinary government influence, particularly with the Republican Party. During the administrations of the 1920s, Morgan men routinely represented the U.S. government at international monetary meetings. President Herbert Hoover frequently phoned Morgan's CEO before breakfast... Benjamin Strong, governor of the New York Federal Reserve Bank from 1914-28 and America's most powerful central banker, began his career at a Morgan-associated bank... This Morgan-Fed connection continues today: Before President Reagan named him chairman of the Federal Reserve, Alan Greenspan served as a corporate director for Morgan."

Sam Natapoff, PhD    "Rogue Whale," American Prospect, Mar. 5, 2004 "Rogue Whale," American Prospect, Mar. 5, 2004 |

|

1929

Stock Market Crashes and Great Depression Begins |

|

| Front page of the Brooklyn Daily Eagle newspaper on Oct. 24, 1929 (also known as Black Thursday) reads "Wall St. in Panic as Stocks Crash." Source: abcnews.go.com |

"During the first half of 1929 an unprecedented boom took place on the New York Stock Exchange. However, prices began to fall from late September and selling began. In less than a month there was a 40% drop in stock value, and this fall continued over the next three years... Once the business cycle faltered, a panic set in. The effects of the crash were hugely to accelerate a downward spiral: real estate values collapsed, factories closed, and banks began to call in loans, precipitating the worldwide Great Depression."

Alan Isaacs  et al., "Stock Market Crash," A Dictionary of World History, 2000 et al., "Stock Market Crash," A Dictionary of World History, 2000 |

| Top |

|

1933 - 1949

Massachussets Supreme Court Rules Insider Information is a "Perk" in Goodwin v. Agassiz • US Senate Exposes JP Morgan & Co.'s Guaranteed Profits to High Profile Clients • US Congress Passes the Securities Act of 1933 • Glass-Steagall Act Prohibits Commercial Banks from Engaging in Inappropriate Securities Activities • Securities Exchange Act of 1934 and the Creation of the SEC • SEC Rule 10b-5 Extends Prohibition of Fraud to the Purchase of Securities |

| Date/Event |

Description |

|

1933

Massachussets Supreme Court Rules Insider Information is a "Perk" in Goodwin v. Agassiz |

"It was 1926... How tantalizing it must have been when an experienced geologist told Cliff Mining's president, Rodolphe Agassiz, that he believed the company could be sitting on a huge lode... Excited over the prospects, Mr. Agassiz... acquired a sizable amount of company stock, traded on the Boston exchange. Meantime, the lode theory was never disclosed.

What resulted was a landmark insider-trading case... After Mr. Agassiz snapped up shares of Cliff Mining, a man named Homer Goodwin sued him, arguing he never would have sold his stake had he known of the geologist's report. Mr. Goodwin's shares wound up in Mr. Agassiz's hands. The case worked its way to the Supreme Judicial Court of Massachusetts, which in 1933 issued its ruling.

While Mr. Agassiz 'had certain knowledge, material to the value of the stock, which the plaintiff did not have,' no wrongdoing was committed, the court found. Only in instances where an insider bought or sold shares in a private, face-to-face transaction might -- and the court stressed might -- he have to disclose material information. By buying Cliff Mining stock on the open market, Mr. Agassiz merely had exercised a perk of being an insider... For nearly the next 30 years, insider-trading cases generally followed Goodwin v. Agassiz."

Rick Wartzman  "A 1920s Insider Trade Was Ruled by Court to Be Merely a Perk," Wall Street Journal, July 3, 2002 "A 1920s Insider Trade Was Ruled by Court to Be Merely a Perk," Wall Street Journal, July 3, 2002 |

|

May 1933

US Senate Exposes JP Morgan & Co.'s Gauranteed Profits to High Profile Clients |

"In May 1933, U.S. Senate Banking Committee counsel Ferdinand Pecora exposed how Morgan [JP Morgan & Co.] reserved shares at reduced prices for certain clients, giving guaranteed profits to former President Calvin Coolidge, Franklin Delano Roosevelt's sitting treasury secretary, the chairmen of the Republican and Democratic national committees, and the CEOs of General Electric, AT&T, and Standard Oil, among others."

Sam Natapoff, PhD    "Rogue Whale," American Prospect, Mar. 5, 2004 "Rogue Whale," American Prospect, Mar. 5, 2004

|

| Political cartoon of JP Morgan & Co., published in the Literary Digest on June 10, 1933. Source: www.sechistorical.org |

"...The high point of the hearings came when he [Ferdinand Pecora] looked at the House of Morgan. Pecora's investigators turned up a 'preferred list' of highly placed Americans allowed by the beneficence of J.P. Morgan and Company to buy low and sell high on insider information. Pecora succeeded in fanning public outrage, making it politically possible for FDR [President Franklin D. Roosevelt] to make good on his promise of financial reform."

Securities and Exchange Commission Historical Society  "431 Days: Joseph P. Kennedy and the Creation of the SEC," www.sechistorical.org (accessed Jan. 13, 2009) "431 Days: Joseph P. Kennedy and the Creation of the SEC," www.sechistorical.org (accessed Jan. 13, 2009) |

|

May 27, 1933

US Congress Passes the

Securities Act of 1933 |

The Securities Act of 1933 was "enacted as a result of the market crash of 1929. The legislation had two main goals: (1) to ensure more transparency in financial statements so investors can make informed decisions about investments, and (2) to establish laws against misrepresentation and fraudulent activities in the securities markets.

The Securities Act of 1933 was the first major piece of federal legislation regarding the sale of securities. Prior to this legislation, the sale of securities was primarily governed by state laws; however, the market crash of 1929 raised some serious questions about the effectiveness of how the markets were being governed. Because of the turmoil surrounding the investing community at this time, the federal government had to bring back stability and investor confidence in the overall system."

Investopedia  "Securities Act of 1933," www.investopedia.com (accessed Jan. 12, 2009) "Securities Act of 1933," www.investopedia.com (accessed Jan. 12, 2009)

Securities Act of 1933 (242 KB)  , (Revised Sep. 30, 2004) , (Revised Sep. 30, 2004) |

|

June 16, 1933

Glass-Steagall Act Prohibits Commercial Banks from Engaging in Inappropriate Securities Activities |

"In 1933 in the aftermath of the Great Depression and its widespread bank failures, Congress enacted the Banking Act of 1933. Four sections of the Banking Act of 1933 are referred to as the Glass-Steagall Act. Many critics believed that banks had engaged in inappropriate securities activities that harmed investors. In particular, critics charged that if a bank had a bad loan to a failing company or even a country, it would sell securities to pay off the loan and leave investors with the poor investment. The Glass-Steagall Act addressed that concern in a very broad way:

• Section 16 - restricted commercial national banks from engaging in most investment banking;

• Section 20 - prohibited any member bank from affiliating in specific ways with an investment bank;

• Section 21 - restricted investment banks from engaging in any commercial banking; and

• Section 32 - prohibited investment bank directors, officers, employees, or principals from serving in those capacities at a commercial member bank of the Federal Reserve System."

Securities Industry and Financial Markets Association (SIFMA)  "Glass-Steagall Act," www.sifma.org (accessed Jan. 29, 2009) "Glass-Steagall Act," www.sifma.org (accessed Jan. 29, 2009)

"...FDR [President Franklin D. Roosevelt] signed the 1933 Glass-Steagall Act, which prohibited commercial banks from underwriting securities, and the next year signed the Securities Exchange Act, which created the Securities and Exchange Commission to police Wall Street and prevent stock manipulation... As president, FDR specifically targeted Morgan [JP Morgan & Co.] via the Glass-Steagall Act."

Sam Natapoff, PhD    "Rogue Whale," American Prospect, Mar. 5, 2004 "Rogue Whale," American Prospect, Mar. 5, 2004 |

|

June 6, 1934

Securities Exchange Act of 1934

and the Creation of the SEC |

|

| SEC seal. Source: SEC website (accessed Jan. 12, 2009) |

|

| SEC Commission on July 2, 1934 (Right to left: Ferdinand Pecora, George C. Mathews, Robert E. Healy, Joseph P. Kennedy, and James M. Landis). Source: SEC Historical Society website |

"Before the Great Crash of 1929, there was little support for federal regulation of the securities markets... During the 1920s, approximately 20 million large and small shareholders took advantage of post-war prosperity and set out to make their fortunes in the stock market. It is estimated that of the $50 billion in new securities offered during this period, half became worthless... When the stock market crashed in October 1929, public confidence in the markets plummeted...

Congress — during the peak year of the Depression — passed the Securities Act of 1933. This law, together with the Securities Exchange Act of 1934, which created the SEC, was designed to restore investor confidence in our capital markets by providing investors and the markets with more reliable information and clear rules of honest dealing... Monitoring the securities industry requires a highly coordinated effort. Congress established the Securities and Exchange Commission in 1934 to enforce the newly-passed securities laws, to promote stability in the markets and, most importantly, to protect investors."

US Securities and Exchange Commission (SEC)  "The Investor's Advocate: How the SEC Protects Investors, Maintains Market Integrity, and Facilitates Capital Formation," www.sec.gov (accessed Jan. 12, 2009) "The Investor's Advocate: How the SEC Protects Investors, Maintains Market Integrity, and Facilitates Capital Formation," www.sec.gov (accessed Jan. 12, 2009)

Securities Exchange Act of 1934 (928KB)  , (Revised Sep. 30, 2004) , (Revised Sep. 30, 2004) |

|

May 1942

SEC Rule 10b-5 Extends Prohibition of Fraud to the Purchase of Securities

|

"In 1942, the Commission was presented with a situation in which the president of a company was buying shares from the existing shareholders at a low price by misrepresenting the company's financial condition. While Securities Act § 17(a)(1) prohibited fraud and misstatements in the sale of securities, there was no comparable provision prohibiting such practices in connection with the purchase of securities. The SEC's Assistant Solicitor accordingly lifted the operative language out of § 17(a), made the necessary modifications, added the words 'in connection with the purchase or sale of any security,' and presented the product to the Commission as Securities Exchange Act Rule l0b-5. It was unanimously approved without discussion...

In the more than 50 years since its adoption, this simple rule has been involved in countless SEC and private proceedings, and applied to almost every conceivable kind of situation... In the 1960s and early 1970s, many federal appellate courts and district courts developed expansive interpretations of Rule 10b-5 (and other antifraud provisions of the securities laws). They applied it to impose liability for negligent as well as deliberate misrepresentations, for breaches of fiduciary duty by corporate management, and for failure by directors, underwriters, accountants and lawyers to prevent wrongdoing by others."

Thomas Lee Hazen, JD    "The Jurisprudence of SEC Rule 10b-5," American Law Institute-American Bar Association Continuing Professional Education (ALI-ABA) website, July 28-29, 2005 "The Jurisprudence of SEC Rule 10b-5," American Law Institute-American Bar Association Continuing Professional Education (ALI-ABA) website, July 28-29, 2005

See Rule 10b-5 in US Insider Trading Laws |

| Top |

|

1950 - 1969

US Congress Establishes a General Code of Ethics for Government Service • SEC Holds "Tipping" as Violation of Rule 10b-5 in Cady, Roberts & Co. • US Congress Tightens Securities Trading Regulations in the Securities Act Amendments of 1964 • US Senate Establishes Senate Select Committee on Standards and Conduct • US House of Representatives Establishes House Committee on Standards of Official Conduct • US Federal Court Establishes "Disclose or Abstain" Precedent in SEC v. Texas Gulf Sulphur • First US Senate Official Code of Conduct • US House of Representatives Adopts First Official House Code of Conduct |

| Date/Event |

Description |

|

July 11, 1958

US Congress Establishes a General Code of Ethics for Government Service |

"During the 85th Congress in 1958, Congress for the first time adopted a general Code of Ethics for Government Service for officials and employees in the three branches of government. Although initially proposed in 1951 by Representative Charles Bennett, the impetus for adoption was a House investigation of presidential chief of staff Sherman Adams, who was alleged to have received valuable gifts from an industrialist being investigated by the Federal Trade Commission. The standards in the 10-point code are still recognized as continuing ethical guidance in the House and Senate, although they were adopted by congressional resolution rather than law and therefore are not legally binding."

Congressional Research Service (CRS)  "Enforcement of Congressional Rules of Conduct: An Historical Overview" (180 KB) "Enforcement of Congressional Rules of Conduct: An Historical Overview" (180 KB)       , updated Nov. 18, 2008 , updated Nov. 18, 2008

Code of Ethics for Government Service (107 KB)  , July 11, 1958 , July 11, 1958 |

|

Nov. 8, 1961

SEC Holds "Tipping" as Violation of Rule 10b-5 in Cady, Roberts & Co. |

"The modern federal insider trading prohibition fairly can be said to have begun with the Securities and Exchange Commission's (SEC or 'Commission') enforcement action in Cady, Roberts & Co. Curtiss-Wright Corporation's board of directors decided to reduce the company's quarterly dividend. One of the directors, J. Cheever Cowdin, was also a partner of stock brokerage firm Cady, Roberts & Co. Before the news was announced, Cowdin informed one of his partners, Robert M. Gintel, of the impending dividend cut. Gintel then sold several thousand shares of Curtiss-Wright stock held in customer accounts over which he had discretionary trading authority. When the dividend cut was announced, Curtiss-Wright's stock price fell several dollars per share. Gintel's customers thus avoided substantial losses.

Cady, Roberts involved what is now known as tipping: an insider who knows confidential information does not himself trade, but rather informs—tips—someone else, who does trade. It also involved trading on an impersonal stock exchange, instead of a face-to-face transaction... The SEC held that Gintel had violated Rule 10b-5."

Stephen M. Bainbridge, JD    "The Iconic Insider Trading Cases," UCLA School of Law, Law & Economics Research Paper Series (Revised Mar. 12, 2008) "The Iconic Insider Trading Cases," UCLA School of Law, Law & Economics Research Paper Series (Revised Mar. 12, 2008)

SEC, In the Matter of Cady, Roberts & Co. (701 KB)  , Nov. 8, 1961 , Nov. 8, 1961 |

|

1964

US Congress Tightens Securities Trading Regulations in the Securities Act Amendments of 1964 |

"Following a period of rapid expansion of the securities markets in the late 1950s and early 1960s, Congress authorized a broad study of the rules, practices, and problems of the securities industry. The Special Study of the Securities Markets (the Special Study) was written in 1963 against a background of concern about 'the danger of uninformed public speculation' in the securities markets and 'evidences of a substantial amount of manipulations.' It was also felt that the tremendous growth in the securities industry since the 1934 act had imposed strains on the regulatory system and revealed structural weaknesses. The Securities Act Amendments of 1964 followed the Special Study. The principal provisions of these amendments extended corporate disclosure requirements to OTC stocks, raised requirements for entry into the securities business, and strengthened disciplinary controls of the SEC over brokers and dealers."

John O. Matthews, PhD    Struggle and Survival on Wall Street: The Economics of Competition Among Securities Firms, 1994 Struggle and Survival on Wall Street: The Economics of Competition Among Securities Firms, 1994 |

|

July 24, 1964

US Senate Establishes Senate Select Committee on Standards and Conduct |

"The Select Committee on Standards and Conduct was established by the Senate on July 24, 1964. In February 1977, following Senate-wide committee reorganization, its name was changed to the Select Committee on Ethics. The bipartisan Committee, which has six members, is authorized to oversee the Senate's self-discipline authority provided by the Constitution...

Until the 1960s, there were no permanent congressional ethics committees, no formal rules governing the conduct of Members, officers, and employees in either House of Congress, nor any consistent approach to the investigation of alleged misconduct. When allegations were investigated, it was usually by special or select committees created for that purpose. Sometimes, however, they were considered by the House or Senate without prior committee action...

When the Select Committee on Standards and Conduct was created in 1964, it was authorized to: (1) investigate allegations of improper conduct which may reflect upon the Senate; (2) investigate violations of laws and rules and regulations of the Senate relating to the conduct of Members, officers, and employees in their official duties; (3) recommend disciplinary action, when appropriate; (4) recommend additional Senate rules to insure proper standards of conduct; and issue advisory opinions and interpretative rulings explaining and clarifying the application of any law, rule, or regulation within its jurisdiction."

US Senate Ethics Manual (2.83 MB)  , 2003 , 2003 |

|

Apr. 13, 1967

US House of Representatives Establishes House Committee on Standards of Official Conduct |

"On April 13, 1967, the House established the Committee on Standards of Official Conduct, to be composed of six members of the majority party and six members of the minority party. The Committee was directed to recommend such changes in laws, rules, and regulations necessary to establish and to enforce standards of official conduct for Members, officers, and employees."

US House Ethics Manual(4.12 MB)  , 2008 , 2008 |

|

Aug. 13, 1968

US Federal Court Establishes "Disclose or Abstain" Precedent in SEC v. Texas Gulf Sulphur |

"The modern federal insider prohibition began taking form in SEC v. Texas Gulf Sulphur [TGS] Co. The TGS opinion rested on a policy of equality of access to information. The court [US Court of Appeals for the Second Circuit] contended that the federal insider trading prohibition was intended to assure that 'all investors trading on impersonal exchanges have relatively equal access to material information.' Put another way, the majority thought Congress intended 'that all members of the investing public should be subject to identical market risks.' Accordingly, under TGS and its progeny, virtually anyone who possessed material nonpublic information was required either to disclose it before trading or abstain from trading in the affected company's securities. If the would-be trader's fiduciary duties precluded him from disclosing the information prior to trading, abstention was the only option."

Stephen M. Bainbridge, JD    "An Overview of US Insider Trading Law: Lessons for the EU?," UCLA School of Law, Law & Economics Research Paper Series, 2004 "An Overview of US Insider Trading Law: Lessons for the EU?," UCLA School of Law, Law & Economics Research Paper Series, 2004

SEC v. Texas Gulf Sulphur (188KB)  , Aug. 13, 1968 , Aug. 13, 1968 |

|

1968

First US Senate Official Code of Conduct |

"In 1968, the Senate adopted its first official code of conduct, with substantial revision and amendment of the code occurring in 1977...

The 1968 Code of Conduct covered four areas: outside employment of officers and employees; the raising and permissible use of campaign funds; the political fund-raising activities of Senate staff; and annual financial disclosure by Members, officers, and designated employees of the Senate and senatorial candidates. With the exceptions of gifts in excess of $50 and honoraria in excess of $300, the information in the disclosure reports was to be kept confidential and not available to the public (since changed to require that statements be publicly available)."

US Senate Ethics Manual (2.83 MB)  , 2003 , 2003 |

|

1968

US House of Representatives Adopts First Official House Code of Conduct |

"On April 13, 1967, the House established the Committee on Standards of Official Conduct... One year later, the House Rules were amended to include a Code of Conduct (currently codified as House Rule 23) and an annual financial disclosure requirement (currently codified as House Rule 26). At the same time, the Committee was made a permanent standing committee with authority to investigate alleged violations of the Code of Conduct and to issue advisory opinions interpreting its provisions."

US House Ethics Manual(4.12 MB)  , 2008 , 2008 |

| Top |

|

1970 - 1979

US Judicial Conference Adopts First Uniform Ethics Code for Federal Judges • Obey Commission Recommends Financial Ethics for House Rules • US House of Representatives Adopts First House Public Financial Disclosure Rule • US Senate Adopts First Senate Public Financial Disclosure Rule • Ethics in Government Act of 1978 Mandates Government-Wide Annual Public Financial Disclosure and Creates the Office of Government Ethics |

| Date/Event |

Description |

|

Apr. 5, 1973

US Judicial Conference Adopts First Uniform Ethics Code for Federal Judges; Supreme Court Compliance Deemed Voluntary |

"The Judicial Conference of the U.S [on Apr. 5, 1973]... announced adoption of a new tough and comprehensive code of ethics for the federal bench. The new code ['Code of Judicial Conduct for United States' Judges], a slightly amplified version of the code of judicial ethics drafted by the American Bar Association in 1972, was designed to apply to all judges on the federal level, except Supreme Court Justices whose compliance would be voluntary.

Judges were never before subject to a uniform ethics code and instead had to rely on a collage of federal law and resolutions of the JudicialConference that were often dated and did not cover certain areas of activity.

Among the precepts of the new code:

- Judges should refrain from serving as officers or directors of any businesses. Service as executors of estates, except those of their own families, should also be rejected.

- Investments should be managed in such a way as to minimize conflicts of interest.

- Periodic, public reports detailing outside income and gifts valued over $100 should be filed.

- Any financial interest in a case should be sufficient to disqualify a judge from a case, no matter how small the interest...

The 670 judges of the federal judiciary would not be obligated by law to obey the new code, due to protection afforded by constitutional guarantees of salary and of life terms. However, compliance of all judges was expected."

"Judiciary: Ethics Code for Judges Adopted," Facts on File World News Digest   , Apr. 14, 1973 , Apr. 14, 1973

Code of Conduct for United States Judges (73 KB)  (revised Sep. 1999) (revised Sep. 1999) |

|

July 1976

Obey Commission Recommends Financial Ethics for House Rules |

"The Obey Commission was established in July 1976 (95th Congress), in the aftermath of Watergate, and directed to make recommendations to the House concerning ethical practices, financial accountability, and administrative operations of the House. These recommendations were set forth in a report entitled Financial Ethics and a resolution, H. Res. 287. The House's adoption, on March 2, 1977, of H. Res. 287 changed the House rules governing financial disclosure, outside earned income, acceptance of gifts, unofficial office accounts, franking privileges, and travel. The Commission also recommended the creation of a select committee with legislative jurisdiction over these areas."

US House Ethics Manual(4.12 MB)  , 2008 , 2008 |

|

Mar. 2, 1977

US House of Representatives Adopts First House Public Financial Disclosure Rule |

H. Res. 287, adopted on Mar. 2, 1977, included the first House public financial disclosure rule and limits on outside earned income in addition to limitations on gifts, franking privilege, and foreign travel.

US House Ethics Manual(4.12 MB)  , 2008 , 2008 |

|

Apr. 1, 1977

US Senate Adopts First Senate Public Financial Disclosure Rule |

"On April 1, 1977, the Senate Code of Conduct was revised and amended, and the procedures and duties of the Ethics Committee were further expanded and developed.

Title I of S. Res. 110, 95th Congress, the Official Conduct Amendments of 1977, included amendments to the Senate Code of Conduct first adopted in 1968. Included were the first public financial disclosure requirements for Members, officers, and employees of the Senate, as well as the first limits on gifts, outside earnings, the franking privilege, the use of the Senate radio and television studios, unofficial office accounts, lame-duck foreign travel, and discrimination in staff employment."

US Senate Ethics Manual (2.83 MB)  , 2003 , 2003 |

|

Oct. 26, 1978

Ethics in Government Act of 1978 Mandates Government-Wide Annual Public Financial Disclosure and Creates the Office of Government Ethics |

The Ethics in Government Act of 1978, enacted on Oct. 26, 1978, mandated government-wide annual public financial disclosure by all senior federal personnel and some employees of the legislative, executive, and judicial branches.

Ethics in Government Act of 1978 (187 KB)

"The Office of GovernmentEthics oversees ethical standards for the White House Office, the Executive Office of the President, and for the executive branch departments. It was created by the Ethics in Government Act of 1978...

The Office of GovernmentEthics develops rules and regulations regarding standards of conduct, identification of conflicts of interest, and financial disclosure in consultation with the attorney general and the Office of Personnel Management. They are officially promulgated by the President, and the Office of GovernmentEthics then supervises compliance by providing government officials with advisory letters and formal advisory opinions that deal with their particular situations."

John J. Patrick, EdD    Richard M. Pious, PhD Richard M. Pious, PhD    and Donald A. Ritchie, PhD and Donald A. Ritchie, PhD    "Office of Government Ethics," The Oxford Guide to the United States Government, 2001 "Office of Government Ethics," The Oxford Guide to the United States Government, 2001 |

|

Top |

|

1980 - 1989

US Supreme Court's Ruling in Chiarella v. US Triggers SEC's Adoption of Rule 14e-3 to Expand Application of Fiduciary Duty • US Court of Appeals 2nd Circuit Upholds Misappropriation Theory in US v. Newman • US Supreme Court Rules 6-3 Against Tippee Liability in Dirks v. SEC • Insider Trading Sanctions Act of 1984 Increases Insider Trading Penalties • Levine, Boesky, and Milken Insider Trading Scandals • US Supreme Court Splits 4-4 on Misappropriation Theory Applicability in Carpenter v. US • Insider Trading and Securities Fraud Enforcement Act of 1988 Expands Insider Trading Penalties • Executive Order 12674 Prohibits Executive Branch Employee Use of Nonpublic Government Information for Private Gain • European Community Directive Coordinates Member States' Regulations on Insider Trading |

| Date/Event |

Description |

|

Mar. 18, 1980

US Supreme Court's Ruling in

Chiarella v. US

Triggers SEC's Adoption of

Rule 14e-3 to Expand Application of Fiduciary Duty |

|

US Supreme Court building. Source: www.supremecourtus.gov

(accessed Jan. 22, 2009) |

"In the 1980 case of Chiarella v. United States, the United States Supreme Court reversed the criminal conviction of a financial printer who gleaned nonpublic information regarding tender offers and a merger from documents he was hired to print and bought stock in the target of the companies that hired him. The case was tried on the theory that the printer defrauded the persons who sold stock in the target to him. In reversing the conviction, the Supreme Court held that trading on material nonpublic information in itself was not enough to trigger liability under the anti-fraud provisions and because the printer owed target shareholders no duty, he did not defraud them. In what would prove to be a prophetic dissent, Chief Justice Burger opined that he would have upheld the conviction on the grounds that the defendant had 'misappropriated' confidential information obtained from his employer and wrongfully used it for personal gain.

In response to the Chiarella decision, the Securities and Exchange Commission promulgated Rule 14e-3 under Section 14(e) of the Exchange Act, and made it illegal for anyone to trade on the basis of material nonpublic information regarding tender offers if they knew the information emanated from an insider. The purpose of the rule was to remove the Chiarella duty requirement in the tender offer context – where insider trading was most attractive and especially disruptive."

Thomas C. Newkirk, LLB    and Melissa A. Robertson, JD and Melissa A. Robertson, JD    "Speech by SEC Staff: Insider Trading - A U.S. Perspective," www.sec.gov, Sep. 19, 1998 "Speech by SEC Staff: Insider Trading - A U.S. Perspective," www.sec.gov, Sep. 19, 1998

Chiarella v. US (114 KB)  , Mar. 18, 1980 , Mar. 18, 1980

See Rule 14e-3 in US Insider Trading Laws |

|

Oct. 30, 1981

US Court of Appeals 2nd Circuit Upholds Misappropriation Theory in US v. Newman

|

|

US Court of Appeals, Second Circuit seal. Source: www.ca2.uscourts.gov

(accessed Jan. 22, 2009) |

"The misappropriation theory was tested in court shortly after Chiarella in United States v. Newman. Newman involved employees of an investment banking firm that advised companies with respect to proposed mergers and acquisitions. The defendants misappropriated confidential information entrusted to their employer and conveyed it to securities traders who purchased stock, then shared the profits from the stock's sale with the defendants. The employees owed no duty to the target company or its shareholders and thus could not be prosecuted under the classical theory of insider trading. On appeal, the Second Circuit affirmed defendants' convictions. The court stated that 'in other areas of the law, deceitful misappropriation of confidential information by a fiduciary . . . has consistently been held to be unlawful . . . . Congress [did not intend] a less rigorous code of conduct under the Securities Acts.'"

Randall W. Quinn, JD    "The Misappropriation Theory of Insider Trading in the Supreme Court: A (Brief) Response to the Many Critics of United States v. O'Hagan," Fordham Journal of Corporate & Financial Law, May 2003 "The Misappropriation Theory of Insider Trading in the Supreme Court: A (Brief) Response to the Many Critics of United States v. O'Hagan," Fordham Journal of Corporate & Financial Law, May 2003

US v. Newman (130 KB)  , Oct. 30, 1981 , Oct. 30, 1981 |

|

July 1, 1983

US Supreme Court Rules 6-3 Against Tippee Liability in Dirks v. SEC

|

"Raymond Dirks, a stock analyst, was told by a former corporate officer about a massive fraud at the officer's former employer, information which Dirks then relayed to his clients. In Dirks, the Supreme Court premised tippee liability on the motives of the tipper, that is to say, the tippee was only under a duty to disclose or abstain when the tipper sought an improper benefit for his information. Where the tipper acts from altruistic, or at least non personal benefit motives, there could be no liability... The Court [in a 6-3 decision] found that Dirks did not breach a direct or derivative duty; his conduct therefore did not break the law."

Linda Chatman Thomsen, JD    "Speech by SEC Staff: Remarks Before the Australian Securities and Investments Commission 2008 Summer School: U.S. Experience of Insider Trading Enforcement," www.sec.gov, Feb. 19, 2008 "Speech by SEC Staff: Remarks Before the Australian Securities and Investments Commission 2008 Summer School: U.S. Experience of Insider Trading Enforcement," www.sec.gov, Feb. 19, 2008

Dirks v. SEC (157 KB)  , July 1, 1983 , July 1, 1983 |

|

1984

Insider Trading Sanctions Act of 1984 Increases Insider Trading Penalties

|

"In the wake of the Chiarella and Dirks decisions, Congress enacted even stronger insider trading penalties available for use by the SEC. The Insider Trading Sanctions Act of 1984 (ITSA) increased civil and criminal penalties for trading while in possession of material nonpublic information. The SEC is authorized to seek disgorgement of profits and a civil penalty of up to three times the profits gained or the loss avoided by the defendant, and the criminal penalty was increased from $10,000 to $100,000. However, while facially applicable to transactions involving misuse of nonpublic material information, ITSA does not define the scope of permissible conduct. Thus it does not alter the availability of a cause of action, merely the penalties that may be imposed. Nevertheless, ITSA has proven to be an effective enforcement weapon. Following its enactment, the SEC has been increasingly vigorous in enforcing insider trading prohibitions and has reached some lucrative settlements."

Thomas Lee Hazen, JD    Federal Securities Law, 2003 Federal Securities Law, 2003

Insider Trading Sanctions Act of 1984 (Summary) (50 KB)  |

|

1986

Levine, Boesky, and Milken Insider Trading Scandals

|

"The same bullet shattered the takeover craze and the greatest money-making boom in Wall Street's history, and it exposed the greatest criminal conspiracy the financial world has ever known. The Greed Decade may have taken four more years to play itself out, but after May 12, 1986, it was doomed...

Dennis Levine... confessed to $12.6 million in insider-trading profits. Ivan Boesky agreed to pay $100 million in forfeitures and penalties; no one pretends now that that is anywhere near the total of his illegal gains over the years. And then there is Michael Milken, whose crimes were far more complex... and ambitious than mere insider trading. In 1986, Milken earned $550 million in salary and bonus alone from an enterprise that had been tainted with illegal activity for years. When he finally admitted to six felonies, he agreed to pay $600 million--an amount larger than the entire yearly budget of the Securities and Exchange Commission."

James B. Stewart, JD    Den of Thieves, 1992 Den of Thieves, 1992

|

|

|

|

Dennis Levine on the July 28, 1986 issue of New York magazine. Source: www.nymag.com |

Ivan Boeksy on the cover of the Dec. 1, 1986 issue of TIME magazine. Source: www.LIFE.com |

Michael Milken. Source: www.mikemilken.com (accessed Jan. 22, 2009) |

|

|

Nov. 16, 1987

US Supreme Court Splits 4-4 on Misappropriation Theory Applicability in Carpenter v. US

|

"Carpenter [v. US] involved R. Foster Winans, a reporter for The Wall Street Journal, who worked on 'Heard on the Street,' a financial news column. He would pass information to David Carpenter, who would then pass it along to Kenneth Felis, a stockbroker. Based on the information which would appear in the next day's column, Felis would buy or sell stock in the affected companies. The defendants used the non-public information, which the newspaper considered its property, to net $690,000 from the scheme.

Since previous cases did not support the proposition that the fiduciary duty an individual owed to his employee could support an action under Rule 10b-5, [US Supreme Court Justice Lewis F.] Powell argued that Carpenter's conduct did not violate the law. This argument swayed Chief Justice Rehnquist and Justice O'Connor to join the draft dissent and grant certiorari. However, before the case was argued, Justice Powell retired; without Powell, the Supreme Court eventually split 4-4 on whether the misappropriation theory was valid for imposing Rule 10b-5 liability. That issue would not be finally decided by the Supreme Court for another ten years [by US v. O'Hagan in 1997]."

Securities and Exchange Commission Historical Society  "Fair to All People: The SEC and Regulation of Insider Trading," www.sechistorical.org (accessed Jan. 21, 2009) "Fair to All People: The SEC and Regulation of Insider Trading," www.sechistorical.org (accessed Jan. 21, 2009)

Carpenter v. US (US Supreme Court) (34 KB)  , Nov. 16, 1987 , Nov. 16, 1987

US v. Carpenter (US Court of Appeals, 2nd Circuit) (158 KB)  , May 27, 1986 , May 27, 1986 |

|

Nov. 19, 1988

Insider Trading and Securities Fraud Enforcement Act of 1988 Expands Insider Trading Penalties

|

"After a number of hearings and considerable debate in the 100th Congress, the President signed the Insider Trading and Securities Fraud Enforcement Act of 1988. This Act expanded the scope of civil penalties to control persons who fail to take adequate steps to prevent insider trading; increased the maximum jail terms for criminal securities law violations from five to ten years, with maximum criminal fines for individuals to be increased from $100,000 to $1,000,000 and for nonnatural persons from $500,000 to $2,500,000; initiated a bounty program giving the SEC discretion to reward informants who provide assistance to the agency; and required broker-dealers and investment advisers to establish and enforce written policies reasonably designed to prevent the misuse of inside information."

Congressional Research Service (CRS)  "Federal Securities Law: Insider Trading" (29 KB) "Federal Securities Law: Insider Trading" (29 KB)       , Jan. 30, 2002 , Jan. 30, 2002

Insider Trading and Securities Fraud Enforcement Act of 1988 (124 KB)  , Nov. 19, 1988 , Nov. 19, 1988 |

|

Apr. 12, 1989

Executive Order 12674 Prohibits Executive Branch Employee Use of Nonpublic Government Information for Private Gain |

On Apr. 12, 1989 US President George H.W. Bush signed Executive Order 12674 titled "Principles of Ethical Conduct for Government Officers and Employees," applicable to employees of the executive branch.

Provisions in the Order dealing with using nonpublic government information for private gain include:

"(a) Public service is a public trust. requiring employees to place loyalty to the Constitution, the laws, and ethical principles above private gain.

(b) Employees shall not hold financial interests that conflict with the conscientious performance of duty.

(c) Employees shall not engage in financial transactions using nonpublic Government information or allow the improper use of such information to futher any private interest."

Executive Order 12674 (42 KB)  , Apr. 12, 1989 , Apr. 12, 1989 |

|

Nov. 13, 1989

European Community Directive Coordinates Member States' Regulations on Insider Trading |

|

|

Flag of the European Union (formerly known as the European Community until 1992). Source: www.europa.eu (accessed Feb. 3, 2009) |

"The European countries have tried to harmonize their insider-trading regulations, which were formalized in the European Community Directive Coordinating Regulations on Insider Trading, adopted Nov. 13, 1989 (The EC Directive). The EC Directive arose out of the 1957 Treaty of Rome establishing the European Economic Community, which mandated creating a single internal European financial market.

At the time the directive was passed, however, four of the 12 members of the EC [European Community] (West Germany, Belgium, Italy and Ireland) had no insider-trading legislation on the books and the remaining eight members (France, England, Luxembourg, the Netherlands, Denmark, Greece, Portugal and Spain) had widely varying statutes. The directive set up a minimum standard of insider-trading regulations and required all member states to follow it."

Hongming Cheng, LLM, PhD    "Insider Trading," Encyclopedia of White-Collar & Corporate Crime, Ed. Lawrence M. Salinger, PhD, 2005 "Insider Trading," Encyclopedia of White-Collar & Corporate Crime, Ed. Lawrence M. Salinger, PhD, 2005

Council Directive 89/592/EEC of 13 November 1989 Coordinating Regulations on Insider Dealing (92 KB)  , Nov. 13, 1989 , Nov. 13, 1989 |

| Top |

|

1990 - 1999

International Securities Enforcement Cooperation Act of 1990 Enlarges SEC's International Role • Securities Enforcement Remedies and Penny Stock Reform Act of 1990 Expands SEC Power • All Public Corporations in the US Switch to Electronic Filing of SEC Documents via Edgar • National Securities Improvement Act of 1996 Modernizes Federal-State Securities Regulation • US Supreme Court Endorses Misappropriation Theory in US v. O'Hagan • SEC Requires "Plain English" Use in Company Prospectuses and Filings • Gramm-Leach-Bliley Act Repeals Glass-Steagall Act |

| Date/Event |

Description |

|

Jan. 23, 1990

International Securities Enforcement Cooperation Act of 1990 Enlarges SEC's International Role |

"The International Securities Enforcement Cooperation Act of 1990 [also known as the Securities Act Amendments of 1990] enlarged the [US Securities Exchange] Commission's ability to address international securities issues in several ways. It amended the securities laws to permit the Commission to institute an administrative proceeding barring, sanctioning, or otherwise placing conditions on a securities professional's ability to engage in Commission-regulated activities if a foreign court or securities authority has found that the professional engaged in illegal or improper conduct.

The law also amended the securities laws to provide confidential treatment for records produced under reciprocal arrangement with foreign securities authorities by exempting the documents from the disclosure obligation of the Freedom of Information Act if a good faith representation is made that disclosure would violate that country's confidentiality requirements. In addition, the law makes explicit the Commission's rulemaking authority to provide access to nonpublic documents and other information to both foreign and domestic authorities. Finally, it authorizes the Commission to accept reimbursement from a foreign securities authority for expenses incurred by the Commission in providing assistance."

Thomas C. Newkirk, LLB    and Melissa A. Robertson, JD and Melissa A. Robertson, JD    "Speech by SEC Staff: Insider Trading - A U.S. Perspective," www.sec.gov, Sep. 19, 1998 "Speech by SEC Staff: Insider Trading - A U.S. Perspective," www.sec.gov, Sep. 19, 1998

Securities Act Amendments of 1990 (159 KB)  , Jan. 23, 1990 , Jan. 23, 1990 |

|

Oct. 15, 1990

Securities Enforcement Remedies and Penny Stock Reform Act of 1990 Expands SEC Power |

"With the Securities Enforcement Remedies and Penny Stock Reform Act of 1990, amendments to the 1934 Act gave the SEC the power in an administrative proceeding to require disgorgement [repayment] of illegal [insider trading] profits."

Thomas Lee Hazen, JD    Federal Securities Law, 2003 Federal Securities Law, 2003

Securities Enforcement Remedies and Penny Stock Reform Act of 1990 (485 KB)  , Oct. 15, 1990 , Oct. 15, 1990 |

|

May 1996

All Public Corporations in the US Switch to Electronic Filing of SEC Documents via EDGAR

|

"EDGAR (Electronic Data Gathering Analysis and Retrieval System) began as a model test program in 1984. EDGAR electronically performs automated collection and indexing of required SEC filings and accelerates the receipt and dissemination to the public of such filings. At first, EDGAR access was only through computer terminals located at various SEC offices or through paid proprietary databases. In 1994, a non-profit organization began to provide free Internet access to EDGAR; as funding ran low, the SEC took over this project. As of May 1996, all domestic public corporations were required to file SEC documents via EDGAR. In 2002, the SEC began to provide real time Web-based access to EDGAR."

Securities and Exchange Commission Historical Society  "Timeline," www.sechistorical.org (accessed Jan. 21, 2009) "Timeline," www.sechistorical.org (accessed Jan. 21, 2009) |

|

Oct. 11, 1996

National Securities Markets Improvement Act of 1996 Modernizes Federal-State Securities Regulation |

"The National Securities Markets Improvement Act of 1996 (NSMIA) made substantial changes to the dual system of federal-state regulation while preserving state anti-fraud authority. For the first time since the New Deal, Congress modernized the relationship between federal and state securities regulators. Congress sought to make the SEC the regulator of nationally based activities, while preserving the role of states over activities that were truly local in nature. At the same time, NSMIA preserved the right of state regulators to prosecute fraud...

Among other things, NSMIA preempts state registration and related requirements in the case of offerings of nationally traded securities and securities of registered investment companies."

Securities Industry and Financial Markets Association (SIFMA)  "National Securities Market Improvement Act," www.sifma.org (accessed Jan. 29, 2009) "National Securities Market Improvement Act," www.sifma.org (accessed Jan. 29, 2009)

National Securities Markets Improvement Act of 1996 (217 KB)  , Oct. 11, 1996 , Oct. 11, 1996 |

|

June 25, 1997

US Supreme Court Endorses Misappropriation Theory in US v. O'Hagan

|

"O'Hagan involved an attorney [James H. O'Hagan] whose firm represented a client contemplating a tender offer for the shares of the Pillsbury Company. Using nonpublic information he acquired through his law firm, Mr. O'Hagan loaded up on Pillsbury stock and call options. Pillsbury's securities soared in value after the announcement of the tender offer and Mr. O'Hagan realized a profit of some $4.3 million. He was convicted at the trial stage, but that conviction was overruled by an intermediate appellate court which rejected the misappropriation theory. The government appealed to the Supreme Court.

In its 1997 opinion, the Supreme Court reversed the appellate court and expressly endorsed the misappropriation theory of insider trading. In so doing, the Court held that the misappropriator, despite owing no duty to shareholders of the company whose stock he trades, in fact, is engaged in a fraud in connection with his securities trading. It is just a different type of fraud — a fraud on the party from whom information was stolen, in breach of the misappropriator's duty to the source. It is the breach of this duty that constitutes the 'deception' required by the federal securities laws."

Linda Chatman Thomsen, JD    "Speech by SEC Staff: Remarks Before the Australian Securities and Investments Commission 2008 Summer School: U.S. Experience of Insider Trading Enforcement," www.sec.gov, Feb. 19, 2008 "Speech by SEC Staff: Remarks Before the Australian Securities and Investments Commission 2008 Summer School: U.S. Experience of Insider Trading Enforcement," www.sec.gov, Feb. 19, 2008

James H. O'Hagan was found guilty of mail fraud, violating insider trading law, and violating an SEC tender offer rule. He was convicted on 57 accounts and sentenced to 41 months in prison.

US v. O'Hagan (448 KB)  , June 25, 1997 , June 25, 1997 |

|

1998

SEC Requires "Plain English" Use in Company Prospectuses and Filings |

"The SEC [US Securities Exchange Commission] required that plain English - such as short sentences, everyday language, active voice and no legal jargon - be used in prospectuses and filings, in an effort to make documents more readable and informative to the retail investor."

Securities and Exchange Commission Historical Society  "Timeline," www.sechistorical.org (accessed Jan. 21, 2009) "Timeline," www.sechistorical.org (accessed Jan. 21, 2009) |

|

Nov. 12, 1999

Gramm-Leach-Bliley Act Repeals Glass-Steagall Act |

"Glass-Steagall was one of the many necessary measures taken by Franklin Delano Roosevelt and the Democratic Congress to deal with the Great Depression... The policy response was to erect a wall between investment banking and commercial banking... In the 1990s, as another bull market took hold, momentum built to overturn Glass-Steagall. Commercial banks were eager to get into high-margin businesses like underwriting hot tech stocks. Brokerage firms saw commercial banks, with their massive customer bases, as great distribution channels for stocks, mutual funds, and other financial products that they created. Generally speaking, the investment banks were the aggressors. In April 1998, Sandy Weill's Travelers, which owned Salomon Smith Barney, merged with Citicorp. The following year, Congress passed and President Clinton signed the Financial Services Modernization Act of 1999, known as the Gramm-Leach-Bliley Act. This law effectively deleted the prohibition on commercial banks owning investment banks and vice versa."

Daniel Gross, AM  "Shattering Glass-Steagall," www.newsweek.com, Sep. 15, 2008 "Shattering Glass-Steagall," www.newsweek.com, Sep. 15, 2008

Gramm-Leach-Bliley Act (425 KB)  , Nov. 12, 1999 , Nov. 12, 1999 |

| Top |

|

2000 - 2004

Regulation FD Addresses Selective Disclosure • Sarbanes-Oxley Act of 2002 Expedites Access to Insider Trading Information • Martha Stewart Is Convicted for Laying About Reasons Behind Stock Trades • Study Reveals Senators Have Edge in Stock Trades |

| Date/Event |

Description |

|

Aug. 15, 2000

Regulation FD Addresses Selective Disclosure

|

"Among the regulations issued by the SEC which may concern insider trading, one in particular, Regulation FD [adopted by the SEC on Aug. 15, 2000], may be mentioned. Regulation FD, a relatively new disclosure rule, addresses selective disclosure. It provides that, when an issuer or any person acting on behalf of the issuer discloses material nonpublic information to certain enumerated persons (typically securities market professionals and holders of the securities), it must disclose that information to the public. The timing of the required disclosure depends upon various factors which are discussed in the rule."

Congressional Research Service (CRS)  "Federal Securities Law: Insider Trading" (29 KB) "Federal Securities Law: Insider Trading" (29 KB)       , Jan. 30, 2002 , Jan. 30, 2002

See Regulation FD in US Insider Trading Laws |

|

July 30, 2002

Sarbanes-Oxley Act of 2002 Expedites Access to Insider Trading Information |

"For company researchers, Sarbanes-Oxley is the silver lining in the bubble-bursting blitz of corporate scandals that hit U.S. markets in 2001 and 2002. In late 2001, Enron collapsed into bankruptcy, taking Arthur Andersen down with it. Between then and mid-2002, Xerox, Adelphia, Worldcom, and Tyco were among the companies in the headlines for executive misconduct and multi-billion dollar restatements...

The Sarbanes-Oxley Act seeks to strengthen accountability by auditors, executives, and boards of directors and to improve communication of companies' activities and financial condition to investors... The law stresses that companies disclose 'on a rapid and current basis' any changes in operations or financial condition...

Before Sarbanes-Oxley, access to insider trading information was mediocre... Insider trading must now be filed electronically through the EDGAR system within 2 days of the transaction. Attention by the companies to insider transaction filings should increase the accuracy of the forms..."

Janet Hartmann  "The Impact of Sarbanes-Oxley," Online magazine, May/June 2004 "The Impact of Sarbanes-Oxley," Online magazine, May/June 2004

Sarbanes-Oxley Act of 2002 (198 KB)  , July 30, 2002 , July 30, 2002 |

|

July 16, 2004

Martha Stewart Is Convicted for Lying About Reasons Behind Stock Trades |

|

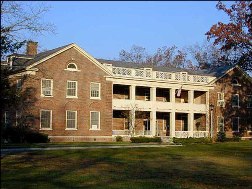

| Alderson Federal Prison Camp, where Martha Stewart served her 5-month prison sentence. Source: New York Times website (accessed Feb. 3, 2009) |

"Martha Stewart received the minimum sentence yesterday -- five months in prison, plus five months of home confinement -- for lying to federal investigators about a stock sale that she called 'a small personal matter.'

...Ms. Stewart also said she would appeal her conviction on charges related to her conduct surrounding the sale of nearly 4,000 shares of ImClone Systems in late 2001, the stock trade that lies at the heart of her legal troubles...

Both she and her former stockbroker, Mr. [Peter E.] Bacanovic, were convicted of conspiring to hide the reasons behind her ImClone trade, which netted her about $227,000. They told investigators that it took place because they had agreed earlier to sell if the share price fell below $60 a share. But Mr. Bacanovic's assistant, Douglas Faneuil, testified that his boss ordered him to tell Ms. Stewart that ImClone's top executive and his family were dumping their shares on Dec. 27, 2001."

Constance L. Hays  "5 Months in Jail, and Stewart Vows, 'I'll Be Back'," New York Times, July 17, 2004 "5 Months in Jail, and Stewart Vows, 'I'll Be Back'," New York Times, July 17, 2004 |

|

Dec. 2004

Study Reveals Senators Have Edge in Stock Trades

|

A Georgia State University study reveals that US Senators' average annual stock performance from 1993 - 1998 beat the market average by approximately 12.3%.

Alan Ziobrowski, PhD    "Abnormal Returns from the Common Stock Investments of the U.S. Senate," Journal of Financial and Quantitative Analysis, Dec. 2004 "Abnormal Returns from the Common Stock Investments of the U.S. Senate," Journal of Financial and Quantitative Analysis, Dec. 2004

Corporate insiders on average outperform the market by 7.4% and stock portfolios of the average US household underperform the market by 1.5%. |

| Top |

|

2005 - 2012

SEC Enforcement Resources Decline • SEC Investigates Alleged Insider Trading by US Senate Majority Leader Bill Frist • Reps. Baird and Slaughter Introduce STOCK Act in 109th Congress • Martha Stewart and SEC Settle on Insider Trading Allegations • Senator Feinstein Resigns from Subcommittee Chair After Report Exposes Conflict of Interest with Husband's Companies • Investigation of Senator Frist's Alleged Insider Trading Ends • Reps. Baird and Slaughter Reintroduce STOCK Act in 110th Congress • Honest Leadership and Open Government Act of 2007 Requires Online Posting of Representatives' Financial Disclosure Reports • US House of Representatives Establishes Office of Congressional Ethics • Reps. Baird and Slaughter Introduce Political Intelligence Disclosure Act in 110th Congress • Reps. Baird and Slaughter Reintroduce STOCK Act in 111th Congress • SEC Changes Leadership and Direction • US House Committee on Financial Services Holds First Hearing on STOCK Act • Reps. Walz and Slaughter Reintroduce STOCK Act in 112th Congress • Study Reveals US House Members Beat Stock Market by 6% • 60 Minutes Report on Insider Trading by Congress Prompts Massive Increase in Co-sponsors for the STOCK Act • President Obama in State of the Union Address Calls for Bill Banning Insider Trading by Members of Congress • STOCK Act Passes in Senate • STOCK Act Passes in House • STOCK Act Signed into Law by Obama |

| Date/Event |

Description |

|

2005-2008

SEC Enforcement Resources Decline |

"In the last few years, the enforcement division of the SEC has been coping with less staff and fewer resources. This is clearly not what has been needed in a time of deregulation and clearly not what Congress had in mind when it enacted Sarbanes-Oxley, specifying an increase in SEC resources in 2002 and stating that enforcement was to be strengthened. By 2006, however, staff turnover was at its highest level in five years. Enforcement groups, normally composed of 15 lawyers, often had only seven or eight lawyers during those years and are slowly being built back to the former numbers. The total number of attorneys able to investigate cases has decreased by 10 percent, from 654 in 2005 to just 594 in 2008...

In the past four years, the SEC's budget allocation has been relatively flat, resulting in declining dollars for an agency that is supposed to be the federal watchdog over the world's largest and most complicated financial market... the SEC has had to freeze needed hiring as the budget allocations failed to keep pace with year-to-year expense increases for existing staff."

"SEC Must Prove It Can Be Watchdog," Securities Industries News   , Feb. 16, 2009 , Feb. 16, 2009 |

|

Sep. 22, 2005

SEC Investigates Alleged Insider Trading by US Senate Majority Leader Bill Frist |

|

| Bill Frist, then US Senate Majority Leader, at a news conference in Des Moines, Iowa on Oct. 22, 2005. Source: Washington Post website |

"The Securities and Exchange Commission has stepped up its probe of Senate Majority Leader Bill Frist's sale of HCA stock by launching a formal investigation into whether Frist broke inside- trading laws.

HCA, which was co-founded by Frist's father and is the USA's No.1 hospital chain, announced Thursday the escalation of what had been an informal inquiry. The company said it's cooperating with authorities... Frist's office disclosed Sept. 22 that the SEC had asked for information related to his stock sale. The next day, Frist's office and HCA said federal prosecutors had sought information about the sale.

At issue is whether Frist sold HCA stock based on inside information he had obtained. In mid-June, Frist ordered the sale of his HCA shares, which, along with other stocks, were in a blind trust. At the time, HCA was trading near its 52-week high. On July 13, after the sale was completed, HCA announced its quarterly earnings would fall short of estimates, driving down the share price 9%.

A blind trust puts control of the owner's holdings in the hands of an outsider. But the rules of Frist's trust allowed him to order the sale of all his holdings in a stock without knowing how much of the stock he owned.

In a statement last week, Frist's office said the senator 'had no information about the company or its performance that was not available to the public. His only objective in selling the stock was to eliminate the appearance of a conflict of interest.'"

Paul Davidson  "SEC Launches Formal Investigation of Frist," USA Today, Sep. 30, 2005 "SEC Launches Formal Investigation of Frist," USA Today, Sep. 30, 2005 |

|

Mar. 28, 2006

Reps. Baird and Slaughter Introduce STOCK Act in 109th Congress |

|

|

US Congressman Brian Baird. Source: www.house.gov (accessed Feb. 3, 2009) |

"Congressman Brian Baird (D-WA) and Congresswoman Louise Slaughter, Ranking Member of the House Rules Committee, (D-NY) today introduced legislation to stop insider trading on Capitol Hill. The lawmakers have also urged the Department of Justice to investigate how widespread Hill insider trading is...

The Stop Trading on Congressional Knowledge Act, or STOCK Act, will prohibit Members and employees of Congress from profiting from nonpublic information they obtain in their official positions, and require greater oversight of the growing 'political intelligence' industry."

Brian Baird, PhD    , "Baird, Slaughter Seek Capitol Hill Insider Trading Ban," Press Release, www.house.gov, Mar. 28, 2006 , "Baird, Slaughter Seek Capitol Hill Insider Trading Ban," Press Release, www.house.gov, Mar. 28, 2006